We’ve got another post from our partner, Phocuswright, and in this article they’re sharing some findings from their research into online travel agencies (OTAs). Read on to find out more about the growth of OTA transactions, and to find out how you can learn more details if your business works with OTAs. Remember, you can save €100 on your ticket to Phocuswright Europe in Amsterdam, if you purchase before 15th April 2017.

Local European OTAs Hold Their Own Among Global Players

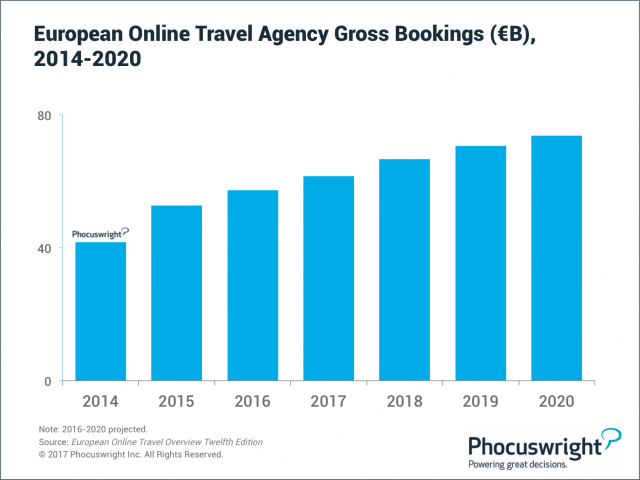

Online travel agencies (OTAs) play a vital role in Europe’s online travel distribution landscape, and in 2016 they accounted for just under half of online travel bookings. While OTA gross bookings accelerated in 2016, the days of double-digit growth are a thing of the past. Following a 26% increase in 2015, OTA transactions climbed a much more modest 9% in 2016. OTAs will continue to benefit from an offline-to-online shift among European travelers. However, a combination of suppliers’ efforts to drive online direct bookings, and legal rulings that will curtail OTAs’ advantage in some markets, will result in stronger growth for the supplier-direct channel for the next several years.

European Online Travel Agency Gross Bookings (€bn), 2014 – 2020

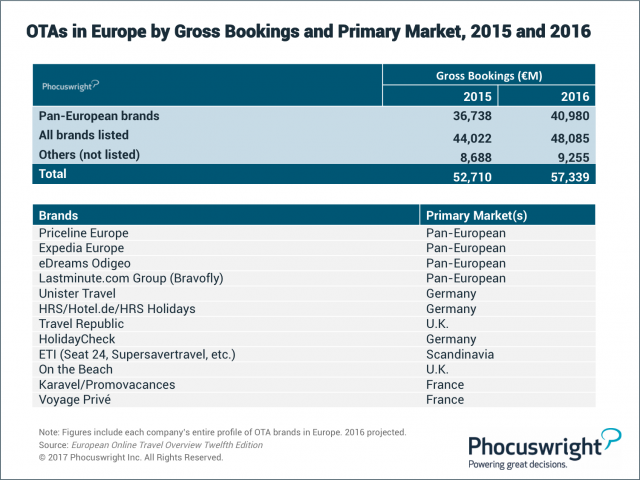

Clearly, some OTAs operating in the European market are better positioned than others to compete with the advancing supplier-direct channel. Priceline’s Booking.com brand continues to dominate, with Expedia a distant second in the European market. The only other OTA with double-digit growth in 2016 is the pan-European lastminute.com Group (Bravofly), which was projected to climb 12%.

Owing to their formidable marketing reach and favorable terms they have negotiated with hotel suppliers, the big pan-European or global players – Priceline, Expedia, eDreams Odigeo and the lastminute.com Group – continue to dominate the European OTA space. In 2016, these top four companies controlled almost a quarter of the category. This share will creep up slightly in 2017 as local players struggle to stay in the game.

OTAs in Europe by Gross Bookings and Primary Market, 2015 and 2016

Despite stiff competition from two titans, several leading OTAs are winning favor in their local markets. Appealing to customer preferences for content and service, these brands have held their own in a world of consolidation, globalization and scale.

Hear how they’re achieving these goals, what’s getting in the way and what’s next for these Local Heroes at Phocuswright Europe – 16-18 May 2017 in Amsterdam, The Netherlands.

Speakers include:

- Fabio Cannavale, Co-Founder and CEO, Lastminute.com Group

- Alexandre Fontaine, Co-Founder and Executive Board Member, Voyage Prive

- Amuda Goueli, CEO, Destinia

- Joerg Trouvain, CEO, 7Travel, ProSieben Travel GmbH

Register before 15 April to save €100 on your ticket!

Photo: Source